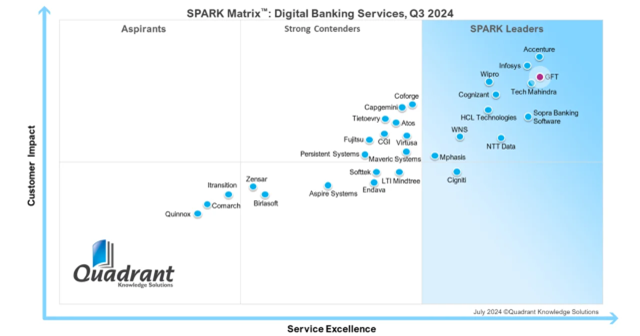

For the 3rd year in a row, GFT has been listed as a Technology Leader in the Quadrant SPARK MatrixTM: Digital Banking Services report. This year GFT has again advanced its leadership position. It is the provider with the highest rating for Service Excellence and one of the top 3 providers for Customer Impact.

According to VVVD Akhilesh, Analyst at Quadrant Knowledge Solutions, “GFT stands out in the global Digital Banking Services market owing to its differentiated offerings, such as a suite of assets and accelerators tailored for digital banking, particularly across platforms like Thought Machine and Mambu.” The analyst added, “With its comprehensive functional capabilities, strong customer value proposition, and compelling ratings across customer impact and service excellence parameters, GFT has been recognised as a leader in the 2024 SPARK Matrix™: Digital Banking Services.”

Marco Santos, Co-CEO at GFT, said: "Being recognised as a Technology Leader in the 2024 SPARK Matrix™ for the third consecutive year is a great honour. This achievement reaffirms GFT’s placement among the very best providers of digital banking services. It reaffirms our commitment to innovation and excellence in this field. These excellent ratings are proof for our team's dedication to delivering unparalleled value and cutting-edge solutions to our clients."

The influential report provides a competition analysis and ranking of the leading digital banking services vendors in the form of the SPARK Matrix™. It provides strategic information for users to evaluate different digital banking services vendors’ capabilities, competitive differentiation, and market position.

Carlton Hopper, UK Managing Director at GFT said: “Once again GFT has been recognised for the quality of our people and the services we deliver for our clients in the retail banking sector. A great example of our highly collaborative approach was the recent development of Salt Bank, the first digital neobank for the Romanian market, alongside Engine by Starling, in just 12 months. This very successful bank is just one of 35+ active core banking projects that GFT currently has underway, highlighting our strength in the retail banking sector worldwide.”

The 2024 SPARK Matrix™ analysis highlights the key differentiators that set GFT apart:

- Tailored Digital Banking Solutions: GFT offers digital banking assets and accelerators including BankLiteX and BankStart, across platforms such as Thought Machine, and Mambu The GFT AI.DA marketplace enhances customer experience and productivity through innovative tools and templates such as the GFT Banking Assistant.

- GFT Digital Banking Launcher (DBL): A cloud-native solution for modern core banking functionalities, facilitating the transition from legacy systems to a modern core banking environment, achieving scalability, flexibility, and real-time processing.

- BankLiteX and BankStart Solutions: Unified development hub for collaboration across UI/UX, DevOps, and operational teams, offering business logic, workflow engines, smart contracts, and configuration management.

Read this press release via the GFT website here