The R&D Tax Credits scheme is a vital resource for businesses in the software industry, enabling them to reduce their corporate tax bill or receive a tax refund based on a proportion of their R&D expenditure. This scheme is available to any limited company in the UK that is liable for corporation tax and meets the necessary R&D criteria, even if the projects are unsuccessful. To qualify, the work must be part of a specific project aimed at making an advance in the field.

Key Benefits of R&D Tax Credits for Software Development

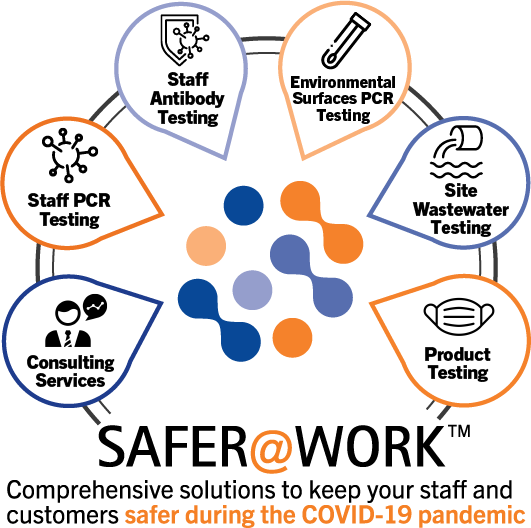

For software companies, R&D can involve developing cutting-edge software, making notable technological enhancements, integrating third-party systems, and creating innovative methods of data management. These activities are crucial in driving technological advancements and maintaining competitive advantage. Since 2010, Leyton has helped thousands of clients claim over £1 billion in R&D tax relief, providing a significant cash injection for businesses developing new processes, products, or services.

Shark Finesse: A Case Study

Shark Finesse, established in 2002, developed a unique software toolset that helps businesses build compelling business cases for investment, translating these into financial ROI reports, and producing justifications to secure necessary budgets. Their Shark ROI Software allows users to create customized, ROI-based business cases for various solutions, from predictive analytics on gas turbines to CRM systems that retain more customers.

Why Shark Finesse Chose Leyton

Shark Finesse partnered with Leyton due to the evolving nature of their product and the need for a comprehensive, hands-on approach to manage their R&D claims. Leyton's expertise allowed Shark Finesse to focus on continuing the development of their offering while ensuring they received a robust and compliant claim. The collaboration enabled Shark Finesse to benefit from additional funding, which accelerated their development process and time to market.

The Impact of R&D Tax Credits

Stephen Jackett, Technical Director at Shark Finesse, highlights the significant impact of Leyton's support: "The additional funding has facilitated our development process, accelerated our time to market, and helped us focus on our core values. Leyton were very easy to work with; their technical knowledge is amazing, and it is obvious they have a very strong background."

About Leyton

Leyton is an international consulting firm that simplifies access to financial incentives, helping businesses accelerate growth and achieve long-lasting performance. With over 26 years of experience, Leyton's team of skilled tax and technical specialists, equipped with cutting-edge digital tools, ensures that clients receive maximum financial benefits without taking risks.